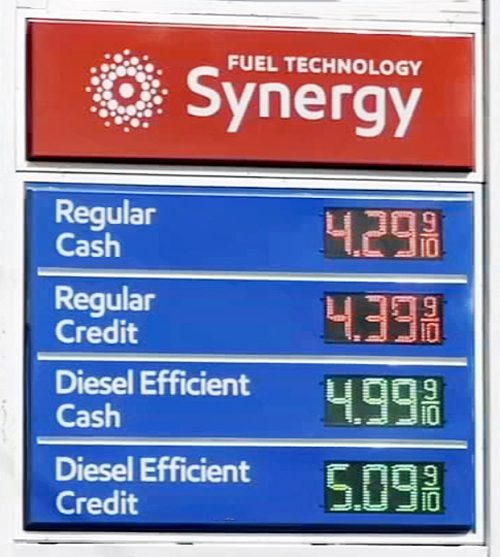

Previously 4 years, gasoline costs have drifted between $4.00 per gallon on the excessive aspect, and roughly $3.25 on the low finish. Traditionally, People are paying comparatively low costs for gas in the meanwhile. That stated, fuel isn’t low-cost, precisely, and it consumes are moderately massive chunk of the common client’s price range.

Ought to I Pay Money for Gasoline?

Gasoline as an annual expense

Per funding web site Motley Idiot, the standard American family purchases roughly 810 gallons of fuel yearly. At $3.25, that’s greater than $2600 a yr to gas the household automobiles. (Additionally, per Motley, the common automobile burns between 448 and 522 gallons of fuel every year, that’s $1600 to $1700 per every automotive.)

With gasoline payments closing in on the value of a month-to-month home cost, it is smart that American shoppers would search for a approach to avoid wasting cash on the fuel pump. However other than attempting to find the most affordable fuel value at fill-up time, how can a automotive proprietor save a bit cash of fuel?

By paying in your gas with money.

Historical past of money reductions

Money reductions for fuel will not be new, however they’re making a comeback. This writer was a “pump jockey” (full-service pump attendant) when fuel costs surged in 1981. The value of normal gasoline rose from a nationwide common of $.86 in 1979, to $1.77 in 1981. Traditionally, this was about probably the most People ever paid for fuel. In 2025 {dollars}, that $1.77 quantities to roughly $6.30 per gallon.

It was at the moment that gasoline retailer started providing money reductions. On the Mobil station I labored at, the low cost for paying with money as an alternative of a bank card was $.03 per gallon. So, clients paying $2.00 per gallon on the full-service pump acquired $.30 per $20 fuel buy for taking the difficulty to pay folding cash as an alternative of a bank card.

Fortunately for me, most clients simply advised me to maintain the change. These had been good occasions.

Why do retailers provide money reductions?

The explanation for the low cost is easy sufficient. Credit score-card processors cost retailers for the service of dealing with transactions. The value per buy may be excessive. Most credit-card firms expenses between 1.5 and three.5 % of the acquisition quantity, with the common coming in at a reported 2.5 %. These numbers are vital, as a result of most gasoline retailers function on web margins as little as 2.0 %.

What about debit playing cards?

Word that debit playing cards purchases are additionally topic to processing charges, although they are often decrease than these for conventional bank cards. Retailers sometimes don’t provide reductions for debit-card utilization.

Money funds cut back retailer prices

To bypass processing charges, many gasoline retailers are once more providing reductions for paying in your fill-up with money as an alternative of a bank card. Although that low cost is often $.05 per gallon, some shops could provide—although usually briefly as a promotion—reductions as deep as $.10 and even $.15.

So, as an alternative of consuming the processing price, some gas retailers provide the choice of paying in your gas buy with old-school money.

Professionals and Cons

The query is, is it definitely worth the effort to pay for gasoline with money, in change for a comparatively small low cost? In analyzing the cash-versus-credit-card professionals and cons, we are going to assume that the per-gallon low cost is $.05, which is often the case.

Professionals

At $.05 per gallon, the common client will save about $.50 to $.75 every fill-up—this assuming a mean 10-15 gallon buy.

- Not Including to Credit score-Automotive Stability

For folk carrying a credit-card steadiness, paying money for a minimum of some purchases can ease the sting of month-to-month curiosity funds.

Cons

I don’t use money a lot anymore, and have been carrying across the identical $100 invoice since Christmas. However paying for gasoline with money will imply making common journeys to the ATM to cowl the gas tab. If that ATM isn’t particularly shut, you’re truly utilizing fuel to save lots of a bit cash on the stuff.

Gasoline pumps don’t settle for payments, so paying with actual cash means strolling into the fuel station to tender cost in individual. Plus, in the event you intend to fill your tank, you’ll doubtless need to overpay the anticipated tab, and revisit the cashier in your change.

Retail fuel stations earn a stunning 70 % of their web income from merchandise aside from fuel. Whereas this contains issues like oil and windshield-washer fluid, it principally contains the likes of cigarettes, beefy jerky, and Mr. Pibb. Strolling into the shop opens the door to driving sweet-and-salty temptation.

Whereas going money could prevent some cash, you’ll lose any rewards factors you’d have earned through the use of your bank card.

Does it make sense to pay with money?

We are saying no. Paying money not solely provides time to your gas-station go to, it actually doesn’t return a lot in the best way of actual worth. Take into account this: In case your bank card pays you 1.0 % money again, there’s little level to pulling out the folding cash. If you are going to buy $1600 value of gasoline in a given yr, you obtain $16.00 money again for doing so.

By paying money, you save a nickel for each gallon bought, which quantities to a 1.5-percent low cost, or about $24.00 yearly. So, your web financial savings for paying money over the course of a yr comes to simply $8.00. Even at a reduction price of $.10 per gallon, the financial savings don’t quantity to a lot.

Higher methods to save cash on fuel

Many gasoline retailers provide app-based rewards applications that embody not solely discounted gas, however perks that embody free espresso, and, at 7-11, the occasional no-cost rooster wings. Listed here are a couple of applications you could wish to contemplate—all of which ought to show extra handy that coping with money:

7-Eleven

The 7Rewards App options reductions on in-store purchases in addition to gasoline.

Circle Ok

Circle Ok affords the comfort of paying by money utilizing a supplied gift-style card. The cardboard combines credit-card comfort with pay-with money costs.

Extra on the Circle Ok Money Card

Exxon and Mobil

These ubiquitous gasoline retailers provide reductions for gasoline in addition to in-store buy. Enroll within the Exxon Mobil Rewards+ program to earn reductions.

Extra on Exxon and Mobil Rewards+

Love’s

Standard on the Interstate, Love’s affords gas reductions by way of the Love’s Join App.

Walmart

Members of Walmart+ can lower your expenses on gas at taking part Exxon and Mobil stations through the use of the Walmart app.

Hearken to the Automotive Stuff Podcast

Money Low cost Photos